File Your Taxes In Just 1 Day

Online Tax Filling Portal

Get your income tax return filed within just 1 day — fast, secure, and fully online. FilerNow helps salaried individuals, freelancers, and businesses stay compliant with tax laws. We offer quick support for NTN registration, ATL listing, and business registration. Start your sole proprietorship, partnership, or private limited company with expert guidance. Our services include sales tax registration, trademark filing, and SECP incorporation. We handle the paperwork, deadlines, and follow-ups so you don’t have to worry. Trusted by 10000+ clients, FilerNow makes tax filing and business setup easy in Pakistan.

File Now

Pakistan's Most

Reliable

Online Tax Filing Portal

File Your Tax Return In Just 1 Day!

Frequently Asked Questions

If you earn from salary, business, or investments, you must file a tax return to stay compliant and avoid penalties.

Just submit your CNIC, income proof & bank details.

👉 First get your NTN, then

File Tax Return, and finally

Become a Filer.

NTN is essential to file taxes and appear in FBR’s system.

Required for salaried persons, freelancers, and business owners.

👉 Register NTN now

Next:

Tax Return Filing →

Filer Registration

Filer status brings lower tax rates, property/car registration savings, and ATL eligibility.

👉 Start from NTN,

file Tax Return, and then

get ATL Status

Sole proprietorship is quick and simple. For scaling and legal protection,

go with a Private Limited company.

👉 Start Business Registration

Also see: Company Registration

GST is required if sales exceed Rs. 10 million

or if you deal in taxable goods/services. It allows you to issue invoices and claim input tax.

👉 Apply for GST

Already a registered business? Start from Business Registration

Yes. PSW & WEBOC are mandatory for international trade, even for small traders or Amazon sellers.

👉 Get PSW License

Already a Filer? Boost with

GST +

PSW License

- https://hackmd.io/@marendfeetwood/BythjW2MWl

- https://whoosmind.com/forums/thread/31827/

- https://postheaven.net/ty0q52d53y

- https://pste.link/exrcq4yr

- https://www.cyberpinoy.net/read-blog/299916_the-real-cost-of-cashing-out-online.html

- https://jobhop.co.uk/blog/marendfeetwood/from-reels-to-real-cashouts-fixing-kyc-roadblocks-in-aussie-igaming

- https://logcla.com/dashiellmorley

- https://plaza.rakuten.co.jp/lyrakettering/diary/202512140000/

- https://jobhop.co.uk/profile/marendfeetwood

- https://hallbook.com.br/blogs/832208/Hidden-Fees-and-Slow-Withdrawals-in-Australia-s-Real-Money

- https://myanimelist.net/profile/lindeverhoeven

- https://blooder.net/read-blog/148465

- https://blooder.net/nerialockwood

- https://social.contadordeinscritos.xyz/blogs/63510/When-Play-Starts-Looking-Like-a-Punt-Protecting-Young-Aussies

- https://www.cyberpinoy.net/nerialockwood

- https://social.contadordeinscritos.xyz/nerialockwood

- https://collectednotes.com/pokiesurfau/unknown

- https://linde-verhoeven.federatedjournals.com/waar-is-mn-geld-gebleven-de-uitbetalingsstress-bij-dubieuze-gokplatforms-in-nl/

- https://blooder.net/read-blog/148520_when-games-start-feeling-like-pokies-protecting-young-aussies-online.html

- https://justpaste.me/Ulhh3

- https://clik.social/read-blog/154757

- https://pokie-surf-australia.bigcartel.com/product/pokiesurf-au

- https://linde-verhoeven.federatedjournals.com/author/linde-verhoeven/

- https://www.cyberpinoy.net/orrinblackwood

- https://theskyhillsnl.mystrikingly.com/

- https://logcla.com/blogs/1093188/When-Domains-Vanish-The-Mirror-Site-Trap-for-Aussie-Real

- https://paper.wf/tnq7g8wfj4

- https://social.contadordeinscritos.xyz/blogs/63435/When-Real-Money-Play-Vanishes-Overnight-Australia-s-Mirror-Site

- https://www.tumblr.com/lindeverhoeven/802894053194842112/uitbetaling-kwijt-de-harde-realiteit-van

- https://myworldgo.com/blog/184959/when-the-web-disappears-mid-spin-site-blocking-and-mirror-domains-in-australia

- https://the-skyhills-nederland.webflow.io/

- https://writeablog.net/d4638fqz8k

- https://zekond.com/orrinblackwood

- https://clik.social/orrinblackwood

- https://amariswentworth.amebaownd.com/

- https://hackmd.io/@marendfeetwood

- https://forum.amzgame.com/thread/detail?id=517323

- https://whoosmind.com/orrinblackwood

- https://www.amebaownd.com/profiles/2907941

- https://www.tumblr.com/lindeverhoeven

- https://blooder.net/orrinblackwood

- https://lawschoolnumbers.com/fardaubosma

- https://bresdel.com/blogs/1321771/Blocked-Back-Again-The-Mirror-Site-Trap-in-Australia-s

- https://bresdel.com/nerialockwood

- https://s.surveyplanet.com/xs5ok61u

- https://pastelink.net/exrcq4yr

- https://amariswentworth.mssg.me/

- https://www.cyberpinoy.net/read-blog/299916

- https://bresdel.com/blogs/1322255/When-Play-Looks-Like-a-Game-But-Acts-Like-a

- https://amariswentworth.mssg.me/

- https://social.contadordeinscritos.xyz/dashiellmorley

- https://hallbook.com.br/dashiellmorley

- https://penzu.com/p/0396651edfc53803

- https://robust-selenium-566.notion.site/KYC-Headaches-in-Aussie-Online-Pokies-and-How-to-Smooth-the-Ride-2c921ada283f8064a4f1da9ac9aa91e5

- https://myworldgo.com/profile/dashiellmorley

- https://pslk.net/exrcq4yr

- https://oliviabuskinsskyhi.wixsite.com/theskyhills

- https://aggskull.boards.net/thread/1317/when-gets-fair-dinkum-cash

- https://rant.li/z2caj0o6r6

- https://www.cyberpinoy.net/nerialockwood

- https://telegra.ph/Betalen-Zonder-Gedoe-zo-pak-je-payment-friction-aan-in-NL-iGaming-12-14

POPULAR SERVICES

Our Services

WHO WE ARE

Our Services

We are just a click Far from you!

Request Call Back

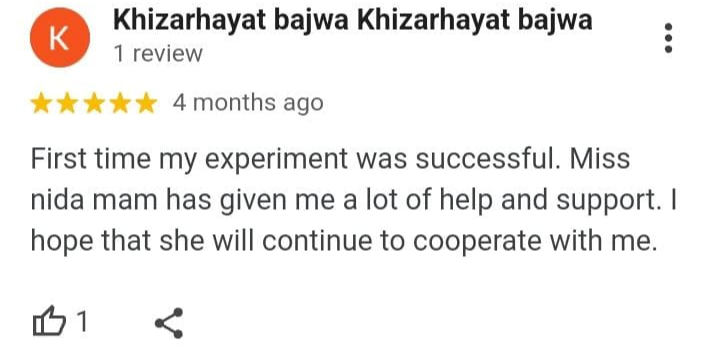

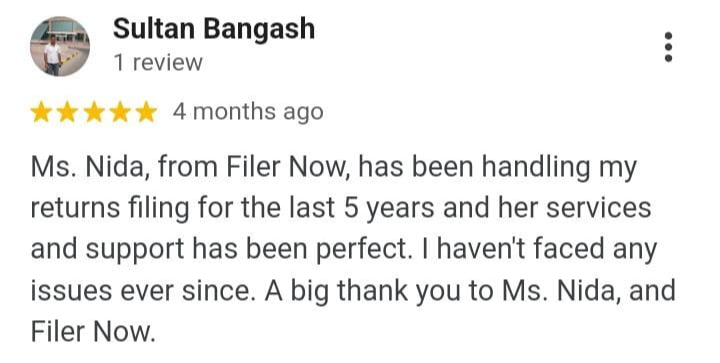

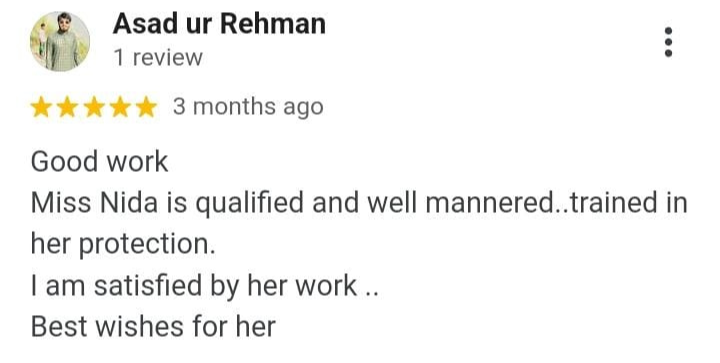

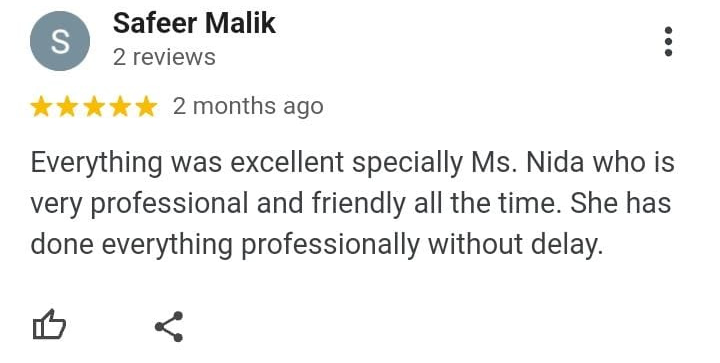

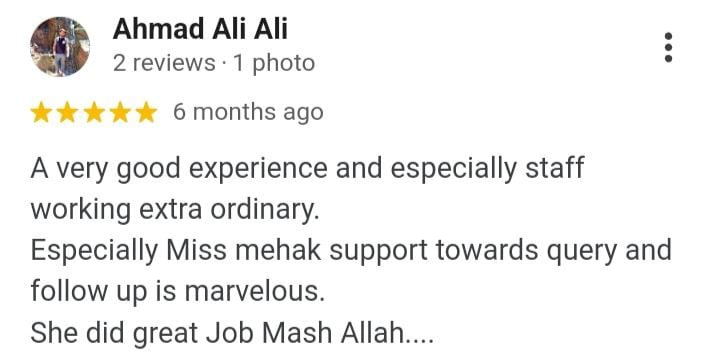

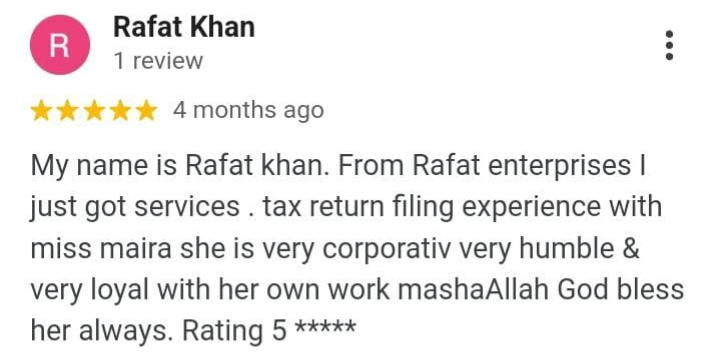

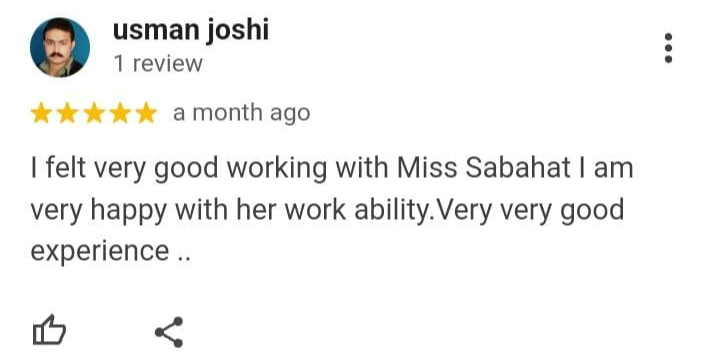

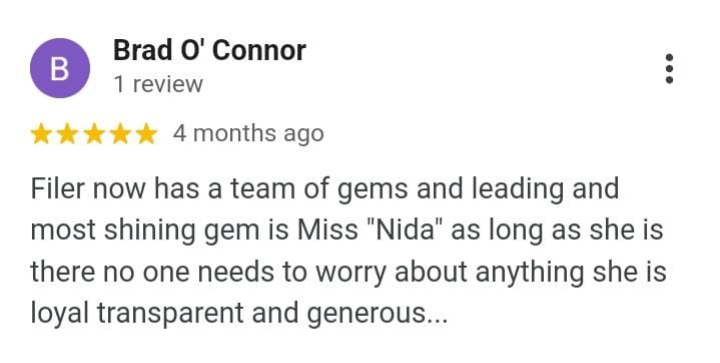

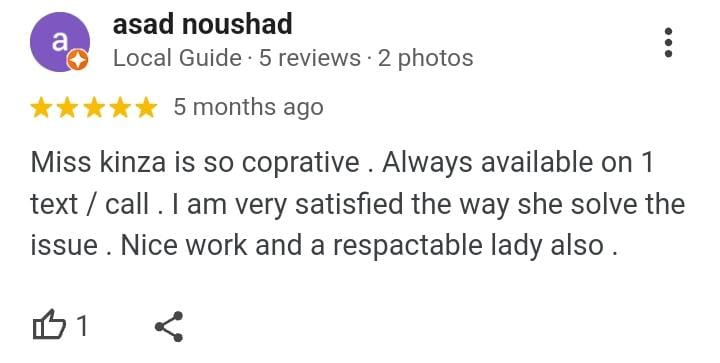

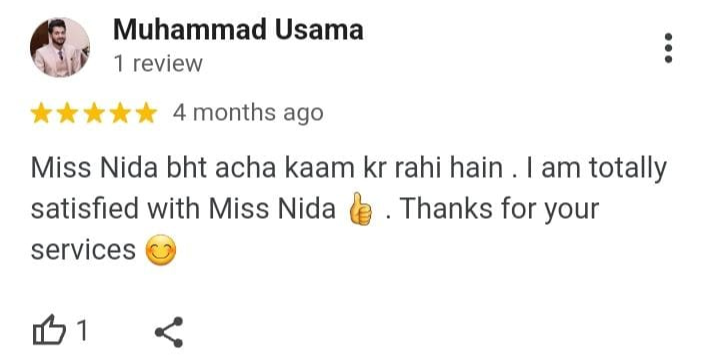

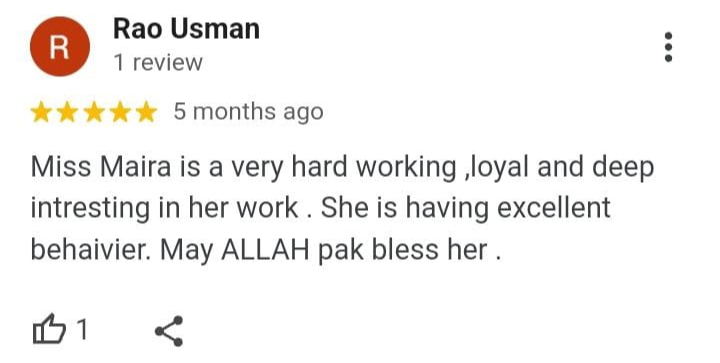

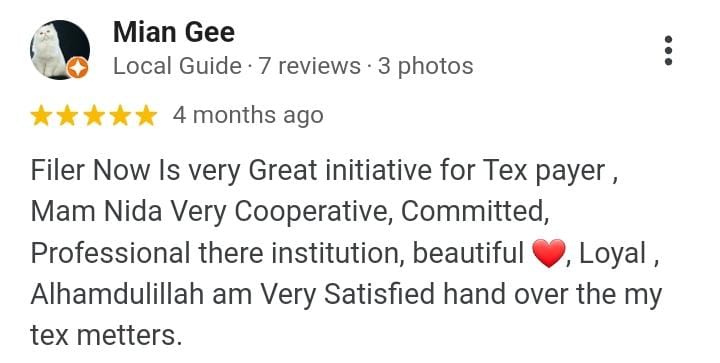

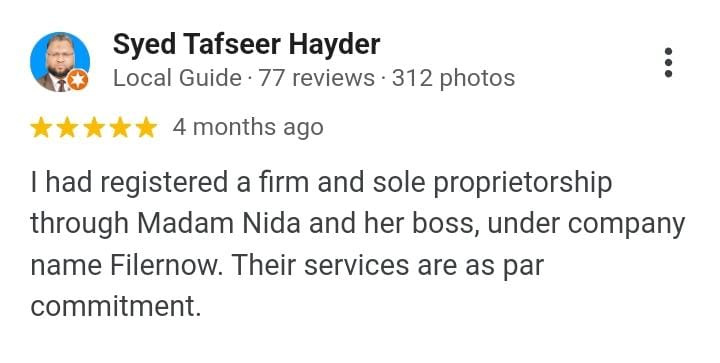

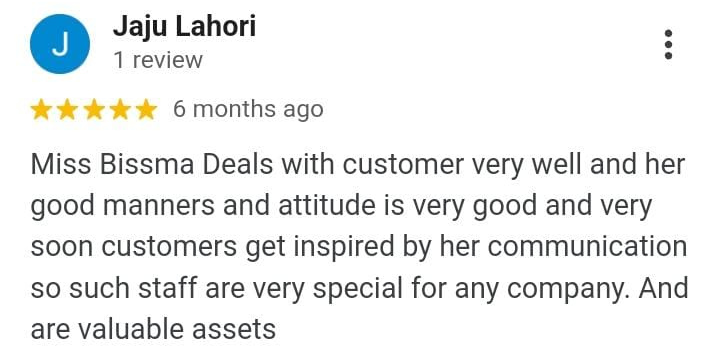

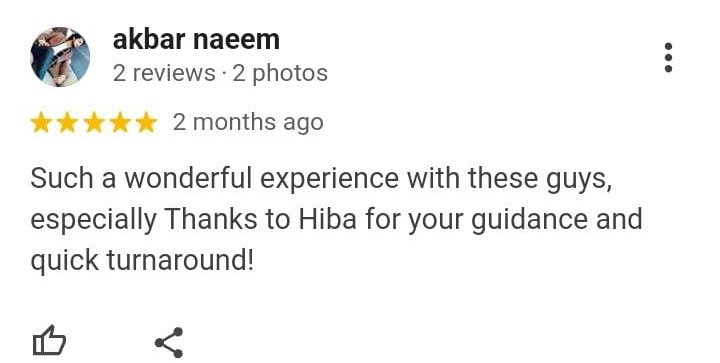

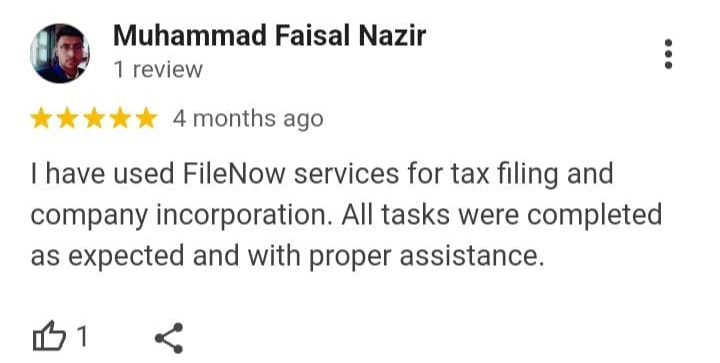

What people have to say about us

"It's a great service to deal with the FBR issues. Staff is very cooperative, helpful and responds quickly."

Muhammad Adeel"I was struggling in tax filing. FilerNow helped me in the process. The team is professional and competent."

Muhammad mughal"My experience has been quite good so far. They focus on customer satisfaction."

Wajahat ali Siddiqui"They handled my sales tax with great care. Smooth process and great support!"

faisal Durrani"Highly recommended service for all tax and business needs in Pakistan!"

Shoaib Shair"Extremely helpful and prompt communication. Truly impressed!"

Asad Rajpoot"Reliable, quick, and professional service. Filing taxes is no longer a pain!"

M. Saboor"The support I got from this team was outstanding."

Qalb e Mominz"Thank you for making tax filing this easy! Great experience."

Ismail Lilla"Definitely recommended. The team is knowledgeable and helpful."

Muhammad Shahid"Smooth, fast, and professional work. I’ll be back next year."

Engr. Shah Nawaz Saeed"This service deserves more praise. It's efficient and clear."

M. Ghufran"I used it for my company registration and it was super easy."

Usman Qureshi"Very responsive support team and great experience overall."

Waqas mughalGoogle Reviews

RECENT BLOGS

Understanding Tax Deductions in Pakistan....

Learn about tax deductions in Pakistan and how to reduce your Read More

How to File Tax Returns in Pakistan

Filing your tax return in Pakistan is essential to avoid FBR Read More

income Tax for Freelancers in Pakistan

Freelancers in Pakistan, learn how to file your income tax quickly Read More

Tax Benefits for Businesses in Pakistan

Discover key tax benefits for businesses in Pakistan and learn how Filernow Read More

Income Tax Return Filing for Salaried Persons...

Learn how salaried persons in Pakistan can easily file their income tax Read More

Tax Penalties in Pakistan – Avoid Fines with...

Learn about tax penalties in Pakistan, the fines for late filing, and Read More

PSW Registration Made Easy – A Complete Guide...

Learn how to register with Pakistan Single Window (PSW) Read More

Tax Audit in Pakistan – Everything You Need...

Understand tax audits in Pakistan and how to prepare for Read More

¿Los juegos de Playuzu tienen tutorial?

Algunos títulos incluyen guías básicas accesibles directamente desde Playuzu https://playuzu.seesaa.net/article/505316131.html?1729510515 para aprender rápidamente.

Cashed casino propose-t-il un support client efficace ?

Une assistance réactive est disponible 24/7 via Cashed casino https://www.investagrams.com/Profile/cashed3225482 pour répondre aux demandes.

Julius casino offre-t-il un programme VIP ?

Un système de récompenses progressives est mis en place sur Julius casino https://vocal.media/authors/jullius-casino offrant des avantages exclusifs.

Olympe casino propose-t-il des jeux live ?

Des tables animées par de vrais croupiers sont accessibles via Olympe casino https://hackaday.io/olympecasinofr pour une immersion totale.